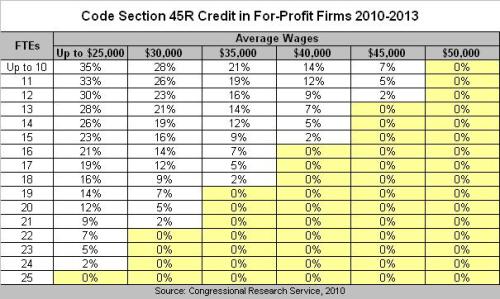

The tax credit is available from 2010 through 2015. For 2010 – 2013 the maximum credit is 35% of qualified premium costs paid by for-profit companies, and 25% for non-profits. The maximum credit is only available to employers with no more than 10 full-time equivalent employees (FTE’s), who are paid average annual wages of $25,000 or less. A reduced credit is available on a phase-out basis for employers with between 10 and 25 FTE’s, who are paid average wages of $25,000 to $50,000. In effect, the credit is reduced by 6.667% for each FTE in excess of 10, and by 4% for each $1,000 in average annual wages paid above $25,000. For example, an employer with 13 full-time equivalent employees who are paid average annual wages of $45,000 will not receive a tax credit. No tax credit is available for employers with 25 or more FTE’s, or who pay average annual wages of $50,000 or more.

In 2014 through 2015, the credit increases to 50% of the amount of qualified premium costs paid by for-profits, and 35% for non-profits, however by then, the employer must participate in a state insurance exchange in order to obtain the credit. [Note: Each state is required to create an insurance exchange by January 1, 2014 which must include an American Health Benefit Exchange, as well as a Small Business Health Options Program (SHOP) Exchange.]

Have you noticed a common theme regarding the above new PPACA ‘Roberts Tax’ rules and regulations? That’s right, the fine for both the individual and for the employers is a fraction of the cost to purchase and maintain health insurance. This is not only why many employers will have a strong impetus to push their employees off of their health insurance plans but it is also why individuals will gladly pay the ‘Roberts Tax’ of $95 in 2014 (which graduates to $695 by 2016) instead of paying for a far more expensive health insurance plan. Worse yet, since the criminal fines (imprisonment) were removed from the PPACA legislation prior to passage. The only recourse that the Federal Government has to collect the ‘Roberts Tax’ is to hold one’s tax refund. Since nearly half of our nation pays no income taxes, how exactly will the IRS hold a tax refund from someone who pays no income taxes?! So, once again, who’s really going to be paying for all of this? That’s right! The few, the proud, the 53% of us who already pay all of the income taxes.

I discussed the impact of the “Roberts Tax” and other issue pertaining to the impact of the PPACA on Small Business owners for the Fox News Business television network on March 28, 2012:

Now that we’ve discussed the impact of the “Roberts Tax” on Individuals, Taxpayers and Business Owners. Let’s take a closer look at all of the 20 new or higher taxes levied upon taxpayers via the PPACA. Arranged by their respective effective dates, below is the total list of all $569 billion in tax hikes (over the next ten years) in the PPACA, where to find them in the bill, and how much your taxes were scheduled to go up based on initial projections by the CBO – Congressional Budget Office in the year 2010.

Taxes that took effect in 2010:

1. Excise Tax on Charitable Hospitals (Min$/immediate): $50,000 per hospital if they fail to meet new “community health assessment needs,” “financial assistance,” and “billing and collection” rules set by HHS. Bill: PPACA; Page: 1,961-1,971

2. Codification of the “economic substance doctrine” (Tax hike of $4.5 billion). This provision allows the IRS to disallow completely-legal tax deductions and other legal tax-minimizing plans just because the IRS deems that the action lacks “substance” and is merely intended to reduce taxes owed. Bill: Reconciliation Act; Page: 108-113

3. “Black liquor” tax hike (Tax hike of $23.6 billion). This is a tax increase on a type of bio-fuel. Bill: Reconciliation Act; Page: 105

4. Tax on Innovator Drug Companies ($22.2 bil/Jan 2010): $2.3 billion annual tax on the industry imposed relative to share of sales made that year. Bill: PPACA; Page: 1,971-1,980

5. Blue Cross/Blue Shield Tax Hike ($0.4 bil/Jan 2010): The special tax deduction in current law for Blue Cross/Blue Shield companies would only be allowed if 85 percent or more of premium revenues are spent on clinical services. Bill: PPACA; Page: 2,004

6. Tax on Indoor Tanning Services ($2.7 billion/July 1, 2010): New 10 percent excise tax on Americans using indoor tanning salons. Bill: PPACA; Page: 2,397-2,399

Taxes that took effect in 2011:

7. Medicine Cabinet Tax ($5 bil/Jan 2011): Americans no longer able to use health savings account (HSA), flexible spending account (FSA), or health reimbursement (HRA) pre-tax dollars to purchase non-prescription, over-the-counter medicines (except insulin). Bill: PPACA; Page: 1,957-1,959

8. HSA Withdrawal Tax Hike ($1.4 bil/Jan 2011): Increases additional tax on non-medical early withdrawals from an HSA from 10 to 20 percent, disadvantaging them relative to IRAs and other tax-advantaged accounts, which remain at 10 percent. Bill: PPACA; Page: 1,959

Tax that took effect in 2012:

9. Employer Reporting of Insurance on W-2 (Min$/Jan 2012): Preamble to taxing health benefits on individual tax returns. Bill: PPACA; Page: 1,957

Taxes that take effect in 2013:

10. Surtax on Investment Income ($123 billion/Jan. 2013): Creation of a new, 3.8 percent surtax on investment income earned in households making at least $250,000 ($200,000 single). This would result in the following top tax rates on investment income: Bill: Reconciliation Act; Page: 87-93

|

|

Capital Gains

|

Dividends

|

Other*

|

|

2012

|

15%

|

15%

|

35%

|

|

2013+

|

23.8%

|

43.4%

|

43.4%

|

*Other unearned income includes (for surtax purposes) gross income from interest, annuities, royalties, net rents, and passive income in partnerships and Subchapter-S corporations. It does not include municipal bond interest or life insurance proceeds, since those do not add to gross income. It does not include active trade or business income, fair market value sales of ownership in pass-through entities, or distributions from retirement plans. The 3.8% surtax does not apply to non-resident aliens.

11. Hike in Medicare Payroll Tax ($86.8 bil/Jan 2013): Current law and changes:

|

|

First $200,000

($250,000 Married)

Employer/Employee

|

All Remaining Wages

Employer/Employee

|

|

Current Law

|

1.45%/1.45%

2.9% self-employed

|

1.45%/1.45%

2.9% self-employed

|

|

Obamacare Tax Hike

|

1.45%/1.45%

2.9% self-employed

|

1.45%/2.35%

3.8% self-employed

|

Bill: PPACA, Reconciliation Act; Page: 2000-2003; 87-93

12. Tax on Medical Device Manufacturers ($20 bil/Jan 2013): Medical device manufacturers employ 360,000 people in 6000 plants across the country. This law imposes a new 2.3% excise tax. Exempts items retailing for <$100. Bill: PPACA; Page: 1,980-1,986

13. High Medical Bills Tax ($15.2 bil/Jan 2013): Currently, those facing high medical expenses are allowed a deduction for medical expenses to the extent that those expenses exceed 7.5 percent of adjusted gross income (AGI). The new provision imposes a threshold of 10 percent of AGI. Waived for 65+ taxpayers in 2013-2016 only. Bill: PPACA; Page: 1,994-1,995

14. Flexible Spending Account Cap – aka “Special Needs Kids Tax” ($13 bil/Jan 2013): Imposes cap on FSAs of $2500 (now unlimited). Indexed to inflation after 2013. There is one group of FSA owners for whom this new cap will be particularly cruel and onerous: parents of special needs children. There are thousands of families with special needs children in the United States, and many of them use FSAs to pay for special needs education. Tuition rates at one leading school that teaches special needs children in Washington, D.C. (National Child Research Center) can easily exceed $14,000 per year. Under tax rules, FSA dollars can be used to pay for this type of special needs education. Bill: PPACA; Page: 2,388-2,389

15. Elimination of tax deduction for employer-provided retirement Rx drug coverage in coordination with Medicare Part D ($4.5 bil/Jan 2013) Bill: PPACA; Page: 1,994

16. $500,000 Annual Executive Compensation Limit for Health Insurance Executives ($0.6 bil/Jan 2013). Bill: PPACA; Page: 1,995-2,000

Taxes that take effect in 2014:

17. Individual Mandate Excise Tax (Jan 2014): Starting in 2014, anyone not buying “qualifying” health insurance must pay an income surtax according to the higher of the following

|

|

1 Adult

|

2 Adults

|

3+ Adults

|

|

2014

|

1% AGI/$95

|

1% AGI/$190

|

1% AGI/$285

|

|

2015

|

2% AGI/$325

|

2% AGI/$650

|

2% AGI/$975

|

|

2016 +

|

2.5% AGI/$695

|

2.5% AGI/$1390

|

2.5% AGI/$2085

|

Exemptions for religious objectors, undocumented immigrants, prisoners, those earning less than the poverty line, members of Indian tribes, and hardship cases (determined by HHS). Bill: PPACA; Page: 317-337

18. Employer Mandate Tax (Jan 2014): If an employer does not offer health coverage, and at least one employee qualifies for a health tax credit, the employer must pay an additional non-deductible tax of $2000 for all full-time employees. Applies to all employers with 50 or more employees. If any employee actually receives coverage through the exchange, the penalty on the employer for that employee rises to $3000. If the employer requires a waiting period to enroll in coverage of 30-60 days, there is a $400 tax per employee ($600 if the period is 60 days or longer). Bill: PPACA; Page: 345-346

Combined score of individual and employer mandate tax penalty: $65 billion/10 years

19. Tax on Health Insurers ($60.1 bil/Jan 2014): Annual tax on the industry imposed relative to health insurance premiums collected that year. Phases in gradually until 2018. Fully-imposed on firms with $50 million in profits. Bill: PPACA; Page: 1,986-1,993

Taxes that take effect in 2018:

20. Excise Tax on Comprehensive Health Insurance Plans ($32 bil/Jan 2018): Starting in 2018, new 40 percent excise tax on “Cadillac” health insurance plans ($10,200 single/$27,500 family). Higher threshold ($11,500 single/$29,450 family) for early retirees and high-risk professions. CPI +1 percentage point indexed. Bill: PPACA; Page: 1,941-1,956

2012 updated CBO & JCT projections reflect a doubling of initial PPACA tax projections.

As is the case with nearly all Government data houses, initial projections are rarely on target. Now, less than 2 years after initial 2010 projections. The Congressional Budget Office (CBO) and the Joint Committee on Taxation (JCT)confirm what America already knew – that the Democrats’ health care law is actually a $1.058 trillion tax hike that families and employers simply cannot afford. The recent Supreme Court ruling left in place 21 tax increases enacted as part of that law, a dozen of which – marked with an asterisk (*) below – target Americans earning less than $200,000 per year for singles and $250,000 per year for married couples, in clear violation of the President’s pledge to avoid tax hikes on low- and middle-income taxpayers. According to the new CBO and JCT estimates, the gross tax increases in the law now total $1.058 trillion over 2013-2022. That new amount is nearly twice the “advertised” ten-year tax hike amount claimed when Democrats originally pushed the law through Congress.

|

Provision

|

March 2010 Estimate

(‘10-‘19)

|

June/July 2012

Re-Estimates

(‘13-‘22)

|

|

Additional 0.9 percent payroll tax on wages and self-employment income and new 3.8 percent tax on dividends, capital gains, and other investment income for taxpayers earning over $200,000 (singles)/$250,000 (married)

|

210.2

|

317.7

|

|

“Cadillac tax” on high-cost plans *

|

32.0

|

111.0

|

|

Employer mandate *

|

52.0

|

106.0

|

|

Annual tax on health insurance providers *

|

60.1

|

101.7

|

|

Individual mandate *

|

17.0

|

55.0

|

|

Annual tax on drug manufacturers / importers *

|

27.0

|

34.2

|

|

2.3 percent excise tax on medical device manufacturers / importers *

|

20.0

|

29.1

|

|

Limit FSAs in cafeteria plans *

|

13.0

|

24.0

|

|

Raise 7.5 percent AGI floor on medical expense deduction to 10 percent *

|

15.2

|

18.7

|

|

Deny eligibility of “black liquor” for cellulosic biofuel producer credit

|

23.6

|

15.5

|

|

Codify economic substance doctrine

|

4.5

|

5.3

|

|

Increase penalty for nonqualified HSA distributions *

|

1.4

|

4.5

|

|

Impose limitations on the use of HSAs, FSAs, HRAs, and Archer MSAs to purchase over-the-counter medicines *

|

5.0

|

4.0

|

|

Impose fee on insured and self-insured health plans; patient-centered outcomes research trust fund *

|

2.6

|

3.8

|

|

Eliminate deduction for expenses allocable to Medicare Part D subsidy

|

4.5

|

3.1

|

|

Impose 10 percent tax on tanning services *

|

2.7

|

1.5

|

|

Limit deduction for compensation to officers, employees, directors, and service providers of certain health insurance providers

|

0.6

|

0.8

|

|

Modify section 833 treatment of certain health organizations

|

0.4

|

0.4

|

|

Other revenue effects

|

60.3

|

222.01

|

|

Additional requirements for section 501(c)(3) hospitals

|

Negligible

|

Negligible

|

|

Employer W-2 reporting of value of health benefits

|

Negligible

|

Negligible

|

|

1099 reporting for small businesses

|

17.1

|

Repealed by P.L. 112-9

|

|

TOTAL GROSS TAX INCREASE

(BILLIONS OF DOLLARS)

|

569.2

|

1,058.3

|

Prepared by Ways and Means Committee Staff – July 24, 2012

1 Includes CBO’s $216.0 billion estimate for “Associated Effects of Coverage Provisions on Tax Revenues” and $6.0 billion within CBO’s “Other Revenue Provisions” category that is not otherwise accounted for in the CBO or JCT estimates.

Dr. Jill Vecchio breaks down the impact of the PPACA on employers:

Blog Source Credited: C Steven Tucker SmallBusinessInsuranceServices.com